Is there a correlation between interest rates and home prices?

What is the working theory between interest rates and home prices?

If you’re in the market to buy a new home or investment property, one thing top of mind will be “what are the current interest rates?” For consumers, interest rates highly dictate buying power, which ultimately influences demand for property which should theoretically influence price. For example, low interest rates means more buying power, which means more demand for housing leading to increased home prices. For high interest rates, the converse would be true

What have we seen historically?

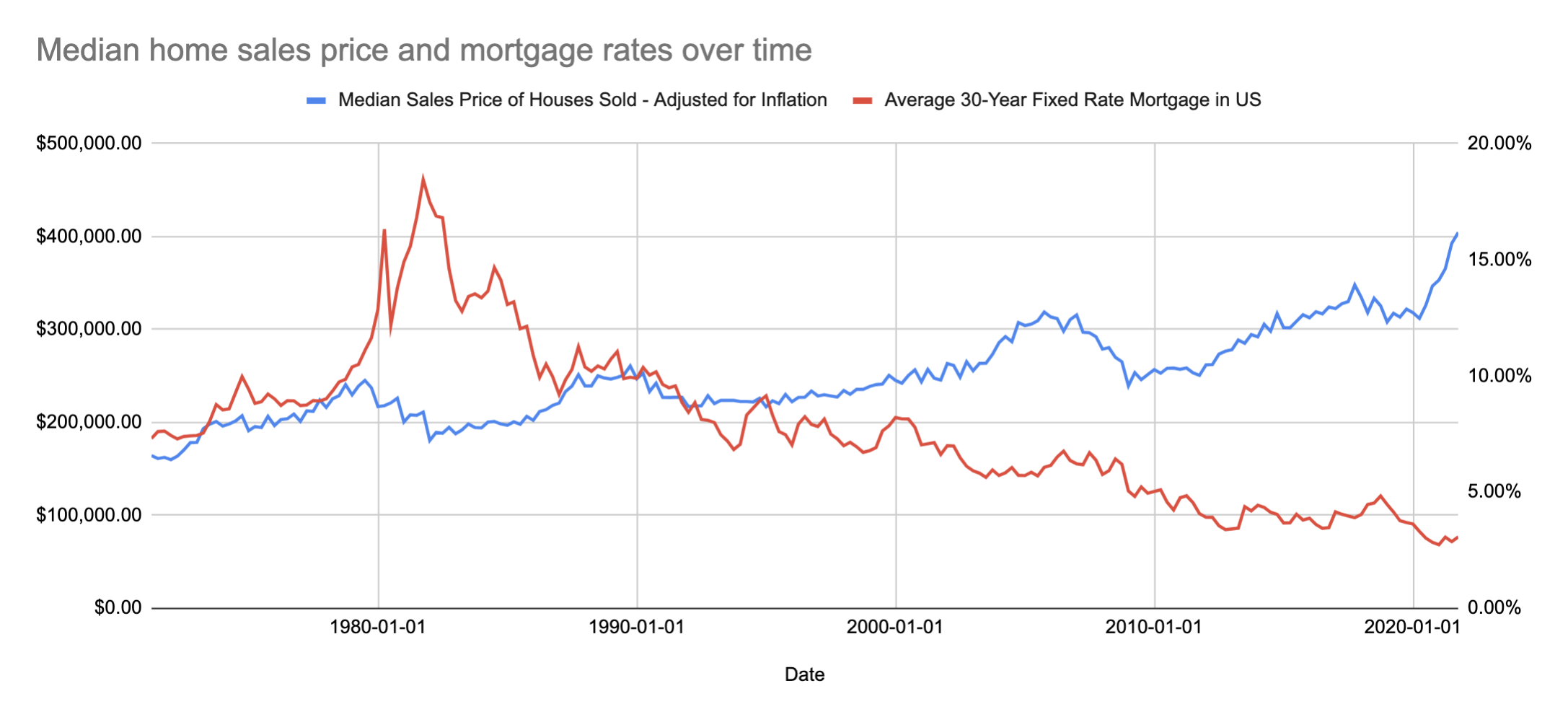

In the past, we’ve seen a weak correlation between home prices and interest rates. The graph below shows the median sales prices of houses sold (adjusted for inflation) and the average 30-year fixed mortgage rate in the US since 1970. You can see from the graph, we’ve had periods of increased interest rates and home prices didn’t always go down.

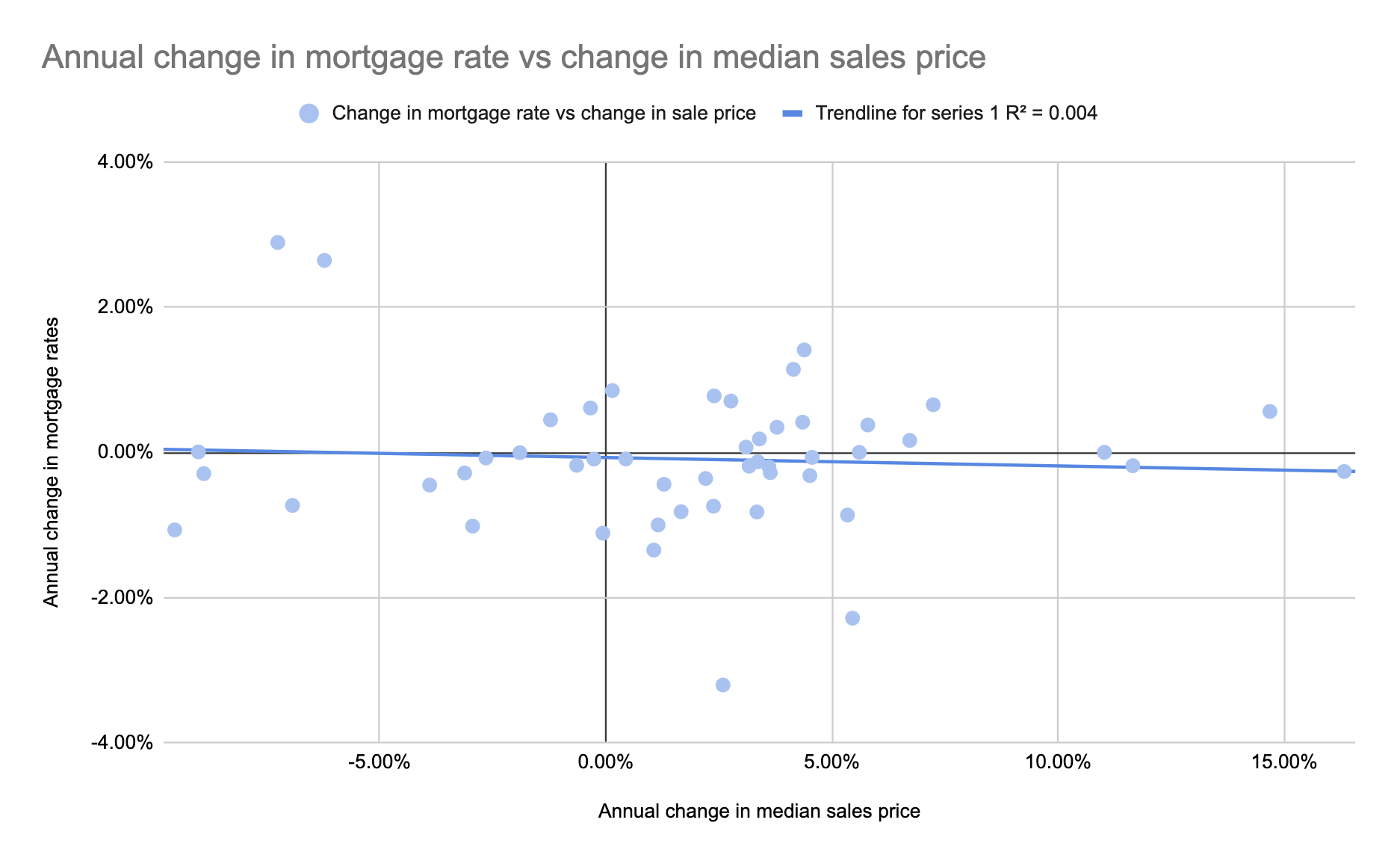

You can see this weak correlation even better in the graph below which shows the annual change in mortgage rates compared to the annual change in median home sales price.

What does this mean for the future of home prices?

No market has a single force driving prices in a given direction. High interest rate environments have typically been associated with periods of high economic growth, high inflation, low unemployment – which all have an impact on the housing market.

In the first graph above, you can see home prices are steadily increasing over time on a macro scale, even when prices are adjusted for inflation. Sure there are dips, but historically prices have recovered within a 5-10 year period and continue to rise.